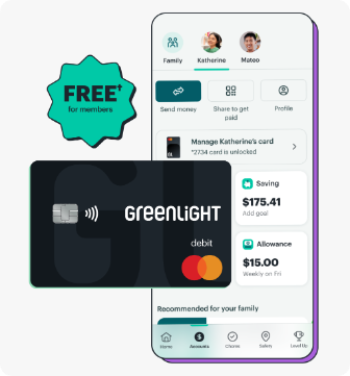

Enjoy Greenlight's

money app and debit

card for free.†

Join 6+ million parents and kids

learning to earn, save, and spend

wisely — together.

Get your free† Greenlight subscription today.

First Peoples members can get the debit card and money app for families for

free through our partnership with Greenlight. To sign up, click the "Get Started"

button above, or visit www.greenlight.com/fpcfcu.

A debit card for kids.

And so much more.

Money management

Send money quickly, set flexible controls,

and get real-time notifications.

Send money quickly, set flexible controls,

and get real-time notifications.

Chores and allowance

Assign chores and automate allowance —

with the option to connect payouts to

chore progress.

Assign chores and automate allowance —

with the option to connect payouts to

chore progress.

Savings goals

Set savings goals for what your kids really

want — and reach them together.

want — and reach them together.

Financial literacy game

Kids play Greenlight Level Up™, the game

that makes money concepts easy to

understand and fun to learn.

Kids play Greenlight Level Up™, the game

that makes money concepts easy to

understand and fun to learn.

What is Greenlight?

First Peoples has partnered with Greenlight to help parents raise financially-smart kids. Greenlight is the loved, trusted financial education app and debit card for kids and teens that allows parents to quickly send their kids money, set up chores & allowance, create savings goals and more. Families who register for Greenlight via the unique link and add your First Peoples account as a funding source will receive Greenlight for free.

Parent’s can add up to 5 kids, each with their own debit card. Once registration is complete, debit cards will be shipped out for each child. When the cards arrive in the mail and are activated they are ready for use!

Parents can:

- Send money to a kid’s card quickly.

- Set parental controls on spending categories.

- Turn a child’s card on/off in one tap.

- Receive real-time notifications whenever a child makes a purchase.

- Assign chores and jobs to teach kids the value of hard work.

- Put allowance on autopilot, and tie it to chore completion.

- Activate Savings Boosts like Round-ups and Parent Paid Interest.

- Facilitate discussions about smart money habits with their kids.

Kids can:

- Use their own debit card (with parental controls in place).

- Swipe their card wherever Mastercard is accepted (including most countries!).

- Set and achieve Savings Goals.

- “Level Up” their money knowledge with Greenlight’s financial literacy game.

- Receive payments from friends and family with Pay Link.

- Earn allowance or payments for completing chores.

- Set up Direct Deposit for an after-school job.

- Add their card to their virtual wallet (Apple Pay®, Google Pay™, Samsung® Pay).

FAQ

What is included in my free† Greenlight subscription?

Your subscription includes debit cards for up to 5 kids, quick money transfers, spending notifications, chores, automated allowance, the financial literacy game Level Up, and more.

Your subscription includes debit cards for up to 5 kids, quick money transfers, spending notifications, chores, automated allowance, the financial literacy game Level Up, and more.

How much does Greenlight cost?

As a First Peoples member, your Greenlight subscription is free†.

As a First Peoples member, your Greenlight subscription is free†.

How do I access my free Greenlight subscription?

If you’re a First Peoples member, you can sign up for your free† subscription

on Greenlight’s website www.greenlight.com/fpcfcu. If you’re new to First Peoples

and/or a current Greenlight customer, you’ll find instructions on signing up for your free†

account there, too.

If you’re a First Peoples member, you can sign up for your free† subscription

on Greenlight’s website www.greenlight.com/fpcfcu. If you’re new to First Peoples

and/or a current Greenlight customer, you’ll find instructions on signing up for your free†

account there, too.

I signed up through my Financial Institution’s link, but I was just charged a monthly fee.

Please contact Greenlight Customer service by calling (888) 483-2645 or texting (404) 974-3024 and inform them you would like to be added to the First Peoples Community Federal Credit Union partnership program.

Please contact Greenlight Customer service by calling (888) 483-2645 or texting (404) 974-3024 and inform them you would like to be added to the First Peoples Community Federal Credit Union partnership program.

Can existing Greenlight customers be added to the program?

Yes! Once existing Greenlight customers add their First Peoples account as a funding source they can reach out to Greenlight customer service and request to be added to the partnership program.

Can I send money to my child’s Greenlight card from First Peoples' app or website?

No, Greenlight is its own individual app, but within the Greenlight app you can send money to your child’s card, turn their card on/off, set up spending controls, allowance, chores and more.

Is there a minimum age to have a Greenlight card?

We support kids and grownups of all ages. No minimum (or maximum) age here. The Primary must be at least 18 years old and a U.S. resident.

Is this a debit or credit card?

Greenlight is a debit card for kids, not a credit card. Parents load money onto the card from their own funding source connected through their Greenlight app. And because it’s a debit card, kids can’t spend what isn’t there. That’s a pretty valuable life lesson.

Is there an app for kids?

Kids and parents will both use the same Greenlight app you see in the app store, but have two different experiences and individual login credentials. Parents can set up their child’s login under the child’s profile settings.

Is Greenlight safe? Are my funds insured?

Greenlight debit cards are FDIC-insured up to $250,000 and come with Mastercard’s Zero Liability Protection. Parents can block ‘unsafe’ spending categories, receive real-time transaction notifications, and turn cards off at any time.

Can Greenlight card be used Internationally?

Yes, the Greenlight card can be used internationally in most countries, and there are no international fees or any foreign transaction fees! For a complete list of countries the card cannot be used click here.

How long does it take for my debit card to arrive?

After completing registration or requesting a replacement card, your debit card will arrive within 7-10 business days. If you would like to expedite your shipping for your card to arrive within 2-3 business days, you can call our customer service team at 888-483-2645 within 12 hours of signing up. You can request to have your shipping expedited for a

one-time fee of $24.99.

How do I verify my funding source?

Bank Account

If you are prompted to verify your Bank Account when manually adding your funding source, you will receive 2 small deposits of $1.00 or less in your bank account within 1-2 business days. To verify your bank account as a funding source, you will need to input the 2 micro deposit amounts into your Greenlight app when prompted to verify.

Bank Account

If you are prompted to verify your Bank Account when manually adding your funding source, you will receive 2 small deposits of $1.00 or less in your bank account within 1-2 business days. To verify your bank account as a funding source, you will need to input the 2 micro deposit amounts into your Greenlight app when prompted to verify.

If you do not see these deposits within 3 business days, please contact your banking service provider directly and have them take a look at the status of your bank account. Once you complete verification, the 2 micro deposits will be removed from your bank account to offset the deposit amounts.

Debit Card

Once you add your debit card as a funding source and make your initial funding load, you should see 2 transactions on your debit card that add up to the initial load amount. You will need to confirm these transactions within 3 business days in the Greenlight app to verify your debit card.

If you do not see these transactions within 4 business days, please contact your banking service provider directly and have them take a look at the status of your bank account.

How do I activate my child’s Greenlight card?

When your child's card arrives, follow these simple steps to activate it right away:

- Open your Greenlight app. From your Parent Dashboard, you should see a notification prompting you to activate your child’s card.

- Tap on the notification and input the card's expiration date and security code in the app to activate it.

- Next, visit your child's dashboard by clicking their square at the top of your Parent Dashboard.

- Select "Manage Card" then "Set debit card PIN." After the PIN is set, your physical card is activated and ready to use!

We have made it super easy to check your child's spending history.

- Navigate to your child's dashboard.

- Click on the Spending tile.

- At the top right, click on "History."

How does money movement work with Greenlight?

In general, funds deposited would be made quickly available to the child given that there’s sufficient funds in the source checking account. The transaction is conducted via ACH transfer and typically would settle the next business day. All funds moved into the Greenlight ecosystem are moved from an externally linked account into the Parent Wallet. These funds can then be distributed, or allocated to children through internal Greenlight fund transfers. Withdrawals are similar, in that funds are removed from the Greenlight ecosystem through the parent wallet. In both cases, funds are moved into or out from the parent wallet via an ACH or debit transaction, using a payment processor. All money transfers within the Greenlight account happen instantaneously.

More Questions? Visit our Help Center here.

How to Contact Greenlight Support

By Phone

- Call 888-483-2645

- Follow the security instructions to verify your account.

- When prompted, indicate that you are calling about the First Peoples Community Federal Credit Union partnership. From there confirm the information & you will be connected with a Greenlight agent.

By Chat (via the Greenlight app):

- Click on the ‘gear symbol’ and navigate to the ‘Help center’.

- Click the “chat” icon in the bottom right corner.

- Type First Peoples Community Federal Credit Union partnership and follow the steps to receive a phone call or text message to get connected to an agent.

| Text Greenlight Support | (404) 974-3024 |

| Call Greenlight Support | (888) 483-2645 |

| Email Greenlight Support | support@greenlight.com |

Helpful Links

The Greenlight card is issued by Community Federal Savings Bank, member FDIC, pursuant to license by Mastercard International.

†First Peoples Community Federal Credit Union customers are eligible for the Greenlight Select Plan at no cost when they connect their First Peoples Community Federal Credit Union account as the Greenlight funding source for the entirety of the promotion. Upgrades will result in additional fees. Members may also choose to upgrade to one of Greenlight’s Partner premium plans: Infinity Select or Family Shield Select. First Peoples Community Federal Credit Union members will receive a $5.99 monthly discount on either plan when they connect an eligible account as their Greenlight funding source. Upon termination of promotion, members will be responsible for associated monthly fees. Offer ends 10/5/2028. Offer, pricing, and First Peoples Community Federal Credit Union participation subject to change. Subject to minimum balance requirements and identity verification. Terms and conditions apply. See First Peoples Community Federal Credit Union and Greenlight terms at greenlight.com/promotionsgeneralterms for full details. Price reflected includes monthly partner discount.

†.Card images shown are illustrative and may vary from the card you receive.

Apple and Apple Pay are registered trademarks of Apple, Inc.

Google Pay is a trademark of Google LLC.

Samsung and Samsung Pay are registered trademarks of Samsung Electronics Co., Ltd.

Google Pay is a trademark of Google LLC.

Samsung and Samsung Pay are registered trademarks of Samsung Electronics Co., Ltd.